The Facts About Stonewell Bookkeeping Revealed

Wiki Article

Little Known Facts About Stonewell Bookkeeping.

Table of ContentsThe Ultimate Guide To Stonewell BookkeepingThe 10-Minute Rule for Stonewell BookkeepingSome Known Facts About Stonewell Bookkeeping.The Definitive Guide for Stonewell BookkeepingSome Known Facts About Stonewell Bookkeeping.

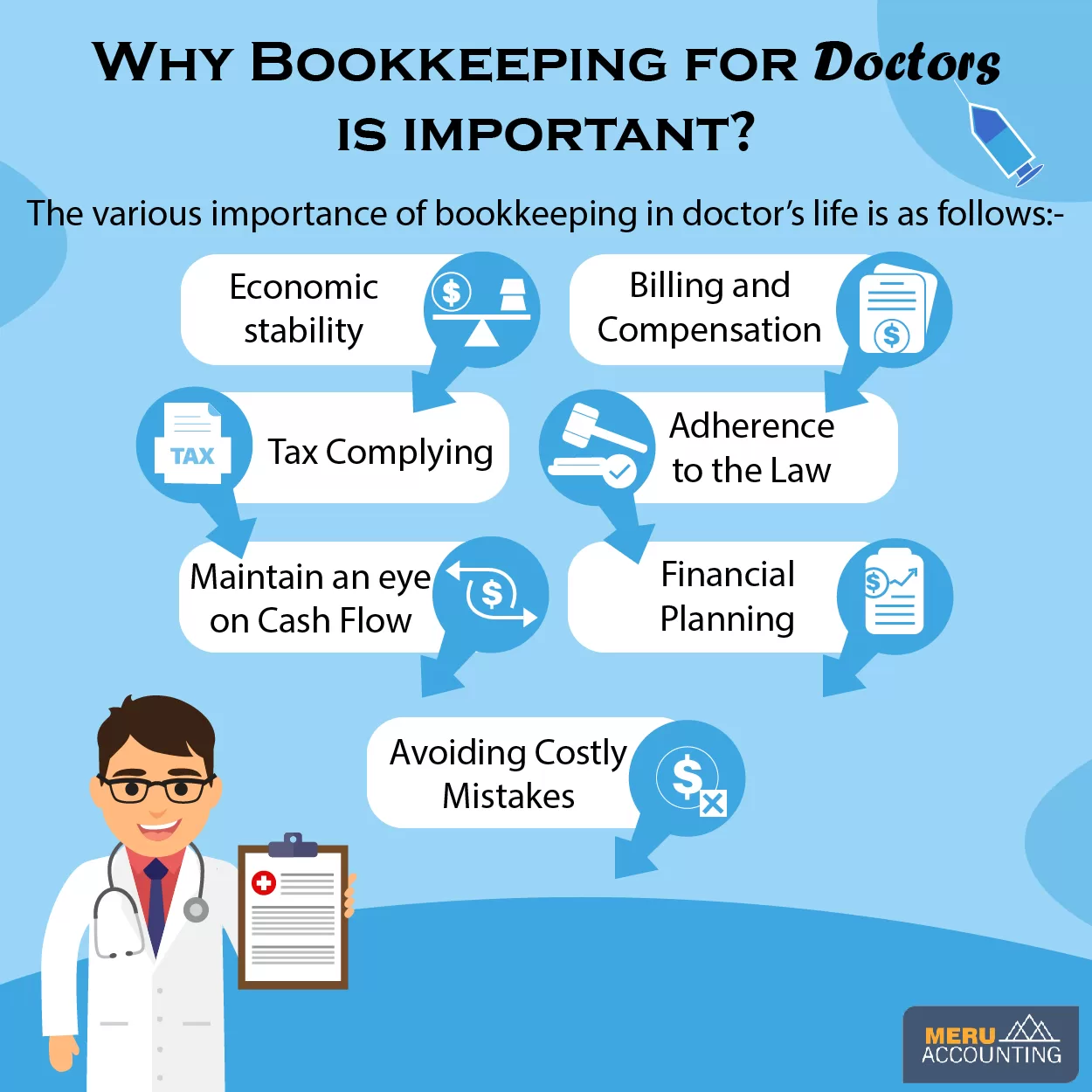

Every organization, from hand-made towel makers to game programmers to dining establishment chains, gains and invests cash. Bookkeepers assist you track all of it. What do they actually do? It's difficult understanding all the response to this question if you have actually been entirely concentrated on growing your organization. You may not fully recognize or perhaps begin to fully appreciate what an accountant does.The history of bookkeeping days back to the start of commerce, around 2600 B.C. Early Babylonian and Mesopotamian accountants maintained records on clay tablets to keep accounts of deals in remote cities. It was composed of a day-to-day diary of every purchase in the sequential order.

Little services may count exclusively on an accountant at first, yet as they expand, having both experts on board comes to be progressively useful. There are 2 main sorts of bookkeeping: single-entry and double-entry accounting. documents one side of a monetary deal, such as including $100 to your cost account when you make a $100 purchase with your bank card.

All about Stonewell Bookkeeping

entails tape-recording economic purchases by hand or making use of spread sheets - franchise opportunities. While low-cost, it's time consuming and prone to mistakes. usages tools like Sage Expenditure Monitoring. These systems immediately sync with your credit score card networks to offer you bank card deal data in real-time, and instantly code all data around expenses including tasks, GL codes, locations, and groups.They ensure that all documents abides by tax policies and laws. They keep an eye on capital and on a regular basis create financial reports that help essential decision-makers in an organization to push business onward. In addition, some bookkeepers also assist in optimizing payroll and billing generation for an organization. An effective accountant needs the complying with abilities: Accuracy is type in financial recordkeeping.

They normally begin with a macro viewpoint, such as a balance sheet or a revenue and loss statement, and after that pierce into the details. Bookkeepers ensure that vendor and client documents are constantly approximately date, even as people and organizations change. They may additionally need to collaborate with various other departments to make sure that every person is utilizing the same data.

All About Stonewell Bookkeeping

Going into expenses right into the accountancy system permits for precise planning and decision-making. This aids organizations obtain repayments quicker and improve money flow.Entail interior auditors and compare their counts with the taped worths. Bookkeepers can work as consultants or internal workers, and their settlement varies depending on the nature of their work.

That being said,. This variation is affected by factors like place, experience, and ability degree. Freelancers typically bill by the hour but might offer flat-rate plans for specific jobs. According to the United States Bureau of Labor Stats, the ordinary bookkeeper income in the USA is. Bear in mind that incomes can differ relying on experience, education, location, and industry.

That being said,. This variation is affected by factors like place, experience, and ability degree. Freelancers typically bill by the hour but might offer flat-rate plans for specific jobs. According to the United States Bureau of Labor Stats, the ordinary bookkeeper income in the USA is. Bear in mind that incomes can differ relying on experience, education, location, and industry.Stonewell Bookkeeping for Beginners

A few of one of the most typical documentation that organizations should send to the federal government includesTransaction info Financial statementsTax conformity reportsCash flow reportsIf your bookkeeping depends on day all year, you can stay clear of a lots of stress throughout tax period. Accounting. Patience and attention to information are essential to far better accounting

Seasonality is a part of any task on the planet. For bookkeepers, seasonality suggests durations when settlements come flying in through the roof covering, where having outstanding work can end up being a severe blocker. It comes to be critical to expect these moments ahead of time and to complete any kind of stockpile before the pressure period hits.

Stonewell Bookkeeping Can Be Fun For Anyone

Preventing this will minimize the threat of triggering an IRS audit as it gives a precise depiction of your funds. Some typical to maintain your personal and organization finances separate areUsing an organization charge card for all your business expensesHaving separate monitoring accountsKeeping receipts for personal and overhead separate Imagine a globe where your accounting is done for you.These combinations are self-serve and call for no coding. It can additional reading automatically import information such as workers, tasks, categories, GL codes, divisions, work codes, expense codes, taxes, and more, while exporting expenses as costs, journal entries, or credit report card charges in real-time.

Consider the complying with tips: A bookkeeper who has actually dealt with services in your industry will better comprehend your particular needs. Accreditations like those from AIPB or NACPB can be an indication of reliability and competence. Ask for references or inspect online testimonials to ensure you're working with somebody trustworthy. is a terrific location to begin.

Report this wiki page